Welcome to our latest blog post where we take a look at 25 scams that you won’t believe actually worked. From historical scams that have been around for centuries, to modern-day cons that have taken advantage of the latest technology, we’ll take you through a journey of deception and trickery. These stories will not only amaze you but also make you more aware of the different types of scams out there and how to protect yourself from falling prey to them.

So, let’s dive in and take a closer look at 25 Shocking Scams that Actually Worked

The Medicine Show

https://en.wikipedia.org/wiki/Medicine_show

https://en.wikipedia.org/wiki/Medicine_show The Medicine Show scam was a type of fraud that was popular in the 19th century, particularly in the United States. It involved traveling salesmen, known as “snake oil salesmen,” who would set up a temporary stage in a town or village and put on a performance, often featuring singing, dancing, and comedy, to attract a crowd.

Once a crowd had gathered, the salesmen would then sell various “miracle cures,” such as snake oil, which they claimed could cure everything from cancer to rheumatism. In reality, these “medicines” were often nothing more than cheap and ineffective concoctions made from alcohol, laxatives, or other common ingredients.

The Three-Card Monte

https://en.wikipedia.org/wiki/Three-card_Monte

https://en.wikipedia.org/wiki/Three-card_Monte The Three-Card Monte, also known as the “Three-card Trick” or “Find the Lady,” is a classic street scam that involves a scammer using sleight of hand to manipulate a game of chance with three cards, usually a queen, a king, and an ace.

The scammer will usually approach an unsuspecting victim and offer to let them bet on which card is the queen. The scammer will then shuffle the cards and allow the victim to pick one, while secretly manipulating the cards so that the victim always chooses the wrong card. The scammer will then take the victim’s money and disappear.

The Pigeon Drop Scam

https://en.wikipedia.org/wiki/Pigeon_drop

https://en.wikipedia.org/wiki/Pigeon_drop The Pigeon Drop Scam is a type of Confidence Trick that involves a scammer pretending to have found a large sum of money and offering to share it with the victim if they can provide a small sum of money as collateral or “good faith” deposit.

The scammer will then ask the victim to withdraw money from their bank account or to give them valuable items such as jewelry or cash as collateral. Once the victim has handed over their money or valuables, the scammer will then disappear with the victim’s money or valuables, leaving the victim with no way to recover their funds or valuables.

The Spanish Prisoner Scam

https://historyhouse.co.uk/articles/spanish_prisoner_swindle.html

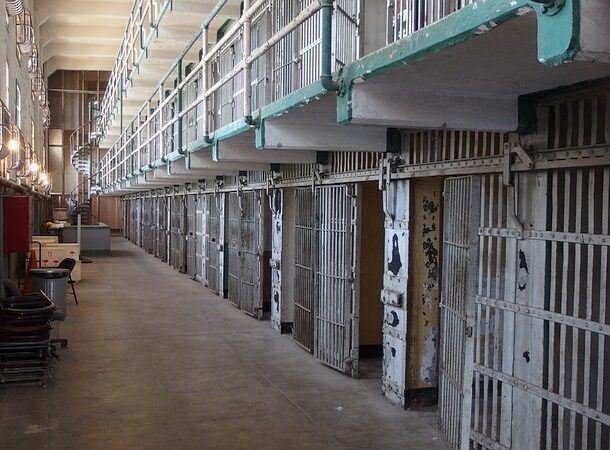

https://historyhouse.co.uk/articles/spanish_prisoner_swindle.html The Spanish Prisoner Scam is an old but still occasionally used scam that has its origins in the late 19th century. It involves a scammer pretending to be a wealthy individual, often a member of the nobility, who is in need of assistance in securing the release of a wealthy but imprisoned relative in Spain.

The scammer will then offer a large sum of money to the victim in exchange for their help in securing the release of the “prisoner.” However, in order to secure the release, the victim is required to pay a series of fees, bribes, and other expenses, which can add up to tens of thousands of dollars.

The scammer will then disappear with the money, leaving the victim with no way to recover their funds or secure the release of the supposed prisoner.

The Confidence Trick

https://en.wikipedia.org/wiki/Confidence_trick#:~:text=A%20confidence%20trick%20is%20an,species%20of%20fraudulent%20conduct%20...

https://en.wikipedia.org/wiki/Confidence_trick#:~:text=A%20confidence%20trick%20is%20an,species%20of%20fraudulent%20conduct%20... The Confidence Trick, also known as a “con game” or “con,” is a type of scam in which a fraudster gains the trust and confidence of their victim by pretending to be someone they are not. They then use this trust to convince the victim to give them money or personal information. These scams are often complex and can involve multiple players working together to create a believable story.

Facebook Scam

https://en.wikipedia.org/wiki/Privacy_concerns_with_Facebook

https://en.wikipedia.org/wiki/Privacy_concerns_with_Facebook The Facebook Scam is a type of scam that takes place on the popular social media platform, Facebook. These scams can take many forms, but often involve a fraudster using a fake profile to trick users into giving away personal information or money.

One common type of Facebook scam is a phishing scam, in which a scammer sends a message to a user posing as a legitimate organization or person and asks for personal information or login credentials. These messages may also include a link to a fake website that looks like the real thing , but is designed to steal personal information.

Real Estate Scam

https://en.wikipedia.org/wiki/Mortgage_fraud

https://en.wikipedia.org/wiki/Mortgage_fraud Real estate scams refer to fraudulent schemes that involve the sale or rental of property, and can take many forms. They can target both buyers and sellers, as well as renters and landlords. One common type of real estate scam is a rental scam, in which a scammer poses as a landlord and lists a property for rent on a website or in a classified ad.

They will ask for a deposit or first month’s rent, but when the victim moves in, they will find that the property is not actually available for rent, or that it is in poor condition.

COVID-19 Vaccine Scam

https://en.wikipedia.org/wiki/COVID-19_scams

https://en.wikipedia.org/wiki/COVID-19_scams Criminals have taken advantage of the high demand for vaccines, using a variety of tactics to steal personal information, money, and other resources from unsuspecting victims. One tactic that scammers may use is to sell fake COVID-19 vaccines.

They may set up fake websites, social media accounts, or text messages that claim to offer vaccines for sale. They may also create fake documents, such as vaccination certificates, to sell to unsuspecting victims.

Zoom Phishing Scam

https://en.wikipedia.org/wiki/Pyramid_scheme

https://en.wikipedia.org/wiki/Pyramid_scheme The Zoom phishing scam is a type of scam that occurs through the Zoom video conferencing platform. Scammers may impersonate Zoom employees, send phishing emails or text messages, or create fake Zoom login pages to steal personal information, such as login credentials, credit card information, or other sensitive data.

To protect yourself from a Zoom phishing scam, it’s important to be cautious when receiving emails or text messages that appear to be from Zoom.

Google Business Listing Scam

https://asmmdigital.com/blog/google-listings-scams

https://asmmdigital.com/blog/google-listings-scams The Google Business Listing scam is a scam in which criminals impersonate Google employees and contact business owners, claiming that their Google Business Listing needs to be verified or updated.

The scammers then ask for personal or financial information, or charge a fee for the “verification” service. These scams are often targeted at small business owners, who may not be aware of the process of creating and managing their Google Business Listing.

Robinhood GameStop Scandal

https://en.wikipedia.org/wiki/GameStop_short_squeeze

https://en.wikipedia.org/wiki/GameStop_short_squeeze The Robinhood GameStop scandal refers to the events of January 2021, when a group of amateur investors, organized on Reddit, coordinated to purchase shares of GameStop, a struggling brick-and-mortar video game retailer, in an attempt to force a short squeeze on Wall Street hedge funds that had bet against the company.

The incident prompted discussions about the power of social media, the potential for market manipulation, and the role of online brokerage firms in regulating trading activity.

Wirecard Scandal

https://en.wikipedia.org/wiki/Wirecard_scandal

https://en.wikipedia.org/wiki/Wirecard_scandal Wirecard had been considered a rising star in the financial technology sector, but in 2020, the Financial Times published a series of articles alleging that the company had inflated its revenue and profits, and that it was hiding large amounts of debt.

Wirecard denied the allegations, but an investigation by the Financial Reporting Enforcement Panel (FREP) found that €1.9 billion were missing from the company’s balance sheet. Wirecard’s CEO Markus Braun was arrested and charged with fraud.

OneCoin Scam

https://en.wikipedia.org/wiki/OneCoin

https://en.wikipedia.org/wiki/OneCoin The OneCoin scam was a Ponzi scheme that was uncovered in 2016, involving a company called OneCoin Ltd. and its associated businesses. The company marketed itself as a cryptocurrency and offered investments in packages that promised high returns on investment.

OneCoin Ltd. claimed to be mining a new cryptocurrency, but in reality, it was simply creating new coins out of thin air and using the money from new investors to pay the returns to earlier investors, making it a classic Ponzi scheme.

Ivan Boesky Scandal

https://www.townandcountrymag.com/society/money-and-power/a8525/ivan-boesky/

https://www.townandcountrymag.com/society/money-and-power/a8525/ivan-boesky/ The Ivan Boesky scandal was a financial scandal that occurred in the United States in the mid-1980s. Ivan Boesky was a prominent Wall Street financier and a well-known corporate raider, who used insider trading to make illegal profits.

The Ivan Boesky scandal was one of the most high-profile financial scandals of the 1980s, and it helped to lead to a number of reforms in securities regulations and increased the oversight of insider trading.

FYRE Festival

https://en.wikipedia.org/wiki/Fyre_%28film%29

https://en.wikipedia.org/wiki/Fyre_%28film%29 The Fyre Festival was a fraudulent music festival that was planned to take place in the Bahamas in 2017. The festival was marketed as a luxury event featuring high-profile musical acts and exclusive experiences, and tickets were sold for tens of thousands of dollars.

However, the festival was plagued by poor planning and mismanagement, and upon arrival, attendees found that the event was not as advertised. Instead of luxury accommodations, they were housed in disaster relief tents, and food and drinks were scarce.

Barry Minkow Scam

https://www.google.com/search?q=ZZZZ+Best+scam+wikipedia&sxsrf=AJOqlzXCKqVU_Lsq4SqSEwgCF5shUuJvCw:1674941088029&source=lnms&tbm=isch&sa=X&ved=2ahUKEwiGg8nkmev8AhWCnGoFHeARAi0Q_AUoAnoECAEQBA&biw=1167&bih=940&dpr=2

https://www.google.com/search?q=ZZZZ+Best+scam+wikipedia&sxsrf=AJOqlzXCKqVU_Lsq4SqSEwgCF5shUuJvCw:1674941088029&source=lnms&tbm=isch&sa=X&ved=2ahUKEwiGg8nkmev8AhWCnGoFHeARAi0Q_AUoAnoECAEQBA&biw=1167&bih=940&dpr=2 The ZZZZ Best scam, also known as the “Barry Minkow scam,” was a massive Ponzi scheme perpetrated by Barry Minkow, a teenage businessman in the 1980s. Minkow founded ZZZZ Best, a carpet cleaning and restoration company, which he falsely claimed was generating millions of dollars in revenue through contracts with major corporations.

In reality, the company had little to no revenue, and Minkow used funds from new investors to pay off earlier investors and fund a lavish lifestyle. The scam was eventually uncovered and Minkow was convicted of fraud and served over 7 years in prison.

Tulip Mania

https://en.wikipedia.org/wiki/Tulip_mania

https://en.wikipedia.org/wiki/Tulip_mania Tulip Mania was a speculative bubble that occurred in the Netherlands in the early 17th century, in which the prices of tulip bulbs reached extraordinary heights before crashing dramatically. Many investors were left with worthless bulbs, and the crash had a ripple effect throughout the Dutch economy, causing a recession.

South Sea Bubble

https://commons.wikimedia.org/wiki/File:South_Sea_Bubble.jpg

https://commons.wikimedia.org/wiki/File:South_Sea_Bubble.jpg The South Sea Bubble was a financial scam that occurred in England during the early 18th century. The South Sea Company, which was granted a monopoly on trade with the Spanish colonies in South America, offered to assume the British government’s debt in return for exclusive trading rights.

Many investors, eager to profit from the anticipated wealth of the colonies, bought shares in the company, causing the stock price to soar. However, the company was unable to fulfill its promises of wealth and profits, and the bubble eventually burst in 1720.

Crypto Scam

https://en.wikipedia.org/wiki/Cryptocurrency_and_crime

https://en.wikipedia.org/wiki/Cryptocurrency_and_crime One common form of crypto scam is the ICO scam, in which a fraudulent company or individual creates a new cryptocurrency and launches an initial coin offering to raise funds.

The company or individual will often create a whitepaper and website that details the benefits of the new currency and encourages investors to purchase the coins, but once the fundraising period is over, the company or individual will disappear with the funds, leaving investors with worthless tokens.

The MMM Scam

https://www.google.com/search?q=The+MMM+Scam+wikipedia&tbm=isch&ved=2ahUKEwiB1calmOv8AhW258kDHdL0DhkQ2-cCegQIABAA&oq=The+MMM+Scam+wikipedia&gs_lcp=CgNpbWcQAzoECCMQJ1DSGVjSGWCrH2gAcAB4AIABYIgBugGSAQEymAEAoAEBqgELZ3dzLXdpei1pbWfAAQE&sclient=img&ei=D5HVY8GRGrbPp84P0um7yAE&bih=940&biw=1167#imgrc=5cfo490Q3VoMbM

https://www.google.com/search?q=The+MMM+Scam+wikipedia&tbm=isch&ved=2ahUKEwiB1calmOv8AhW258kDHdL0DhkQ2-cCegQIABAA&oq=The+MMM+Scam+wikipedia&gs_lcp=CgNpbWcQAzoECCMQJ1DSGVjSGWCrH2gAcAB4AIABYIgBugGSAQEymAEAoAEBqgELZ3dzLXdpei1pbWfAAQE&sclient=img&ei=D5HVY8GRGrbPp84P0um7yAE&bih=940&biw=1167#imgrc=5cfo490Q3VoMbM The MMM Scam is a Ponzi Scheme that was started by Sergei Mavrodi, a Russian businessman, in the late 1980s. The scheme promised investors high returns on their investments, typically around 100% per month, and attracted a large number of participants, particularly in countries such as Russia, South Africa, and Nigeria.

Mavrodi promised that the returns would be generated through a variety of business activities, including trading on the stock market and currency speculation. The scheme collapsed in 1994, leaving millions of investors out of pocket, with many losing their life savings.

Theranos Scandal

https://www.google.com/search?q=Theranos+Scandal+wikipedia&sxsrf=AJOqlzWRWz8yRsSP4FqiVIjed_7L2FtKbg:1674940685596&source=lnms&tbm=isch&sa=X&ved=2ahUKEwievNakmOv8AhVDl2oFHdRZDR8Q_AUoAnoECAIQBA&biw=1167&bih=940&dpr=2#imgrc=Gp2cq-LL_C-Z0M

https://www.google.com/search?q=Theranos+Scandal+wikipedia&sxsrf=AJOqlzWRWz8yRsSP4FqiVIjed_7L2FtKbg:1674940685596&source=lnms&tbm=isch&sa=X&ved=2ahUKEwievNakmOv8AhVDl2oFHdRZDR8Q_AUoAnoECAIQBA&biw=1167&bih=940&dpr=2#imgrc=Gp2cq-LL_C-Z0M The Theranos scandal was a high-profile scandal that came to light in 2015 involving the embattled diagnostics company Theranos, and its founder, Elizabeth Holmes. The scandal centered on the company’s claim that it had developed a revolutionary blood-testing device called Edison, which could perform a wide range of diagnostic tests using a small amount of blood, obtained through a simple finger-prick, rather than a traditional blood draw.

However, an investigation by the Wall Street Journal in 2015 revealed that the company’s technology was inaccurate and unreliable, and that the company had misled investors, patients, and the government about its technology and its ability to perform the tests it advertised.

Nigerian Letter Scam

https://www.veridiancu.org/faq/7979/what-is-nigerian-letter-fraud

https://www.veridiancu.org/faq/7979/what-is-nigerian-letter-fraud The Nigerian letter scam, also known as the “419 scam” or “advance fee fraud”, is a type of scam that originated in Nigeria and has spread globally. The scam typically involves an unsolicited email or letter, often written in broken English, in which the scammer poses as a wealthy individual or government official and requests help in transferring a large sum of money out of the country.

The scammer offers a large percentage of the money in exchange for the victim’s assistance and requests an upfront fee or personal information in order to move forward with the transaction.

Madoff Investment Scandal

https://en.wikipedia.org/wiki/Madoff_investment_scandal

https://en.wikipedia.org/wiki/Madoff_investment_scandal Madoff, the founder of Bernard L. Madoff Investment Securities LLC, was arrested in December 2008 and charged with securities fraud, wire fraud, and other crimes in connection with a Ponzi scheme that he had operated for decades.

The scheme, which was one of the largest and longest-running financial frauds in history, resulted in billions of dollars in losses for Madoff’s clients, including individuals, charities, and institutional investors.

Enron Scandal

https://en.wikipedia.org/wiki/Enron_scandal

https://en.wikipedia.org/wiki/Enron_scandal The Enron scandal was a financial scandal that came to light in 2001, involving the collapse of the Enron Corporation, an American energy company based in Houston, Texas. Enron, once considered one of the most innovative and successful companies in the United States, was found to have engaged in a widespread accounting fraud that inflated the company’s reported financial performance and hid billions of dollars in debt.

Charles Ponzi Scheme

https://www.google.com/search?q=Charles+Ponzi+Scheme+Wikipedia&sxsrf=AJOqlzWqM3XmIF-izbQXr3Ow77KCNXSn-A:1674940195244&source=lnms&tbm=isch&sa=X&ved=2ahUKEwip3-26luv8AhXbmGoFHfWHANoQ_AUoAXoECAEQAw&biw=1167&bih=940&dpr=2

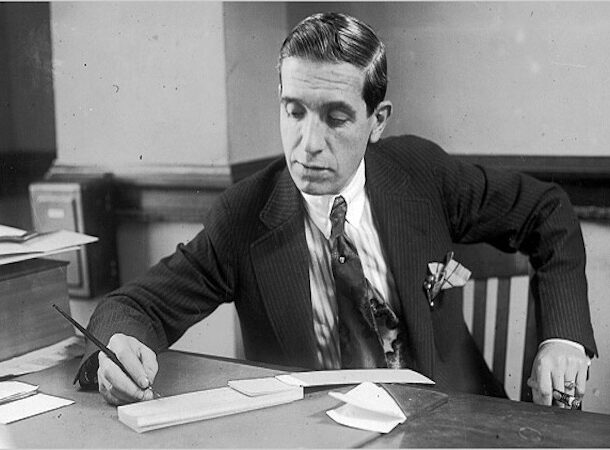

https://www.google.com/search?q=Charles+Ponzi+Scheme+Wikipedia&sxsrf=AJOqlzWqM3XmIF-izbQXr3Ow77KCNXSn-A:1674940195244&source=lnms&tbm=isch&sa=X&ved=2ahUKEwip3-26luv8AhXbmGoFHfWHANoQ_AUoAXoECAEQAw&biw=1167&bih=940&dpr=2 Charles Ponzi was born in 1882 in Italy and immigrated to the United States in 1903. He began his career as a businessman by working for a number of companies, but he quickly became involved in fraudulent activities.

In 1919, he began promoting a scheme in which he promised investors high returns by buying and selling International Reply Coupons (IRCs). However, Ponzi was not actually buying and selling any IRCs, and the scheme was entirely fraudulent.