Corruption, bribery, fraud, and other instances of corporate greed, which are pervasive in the business sphere, significantly impact the entire economy. This is mainly due to the economy’s strong dependence on trust and credit.

Once you remove honesty, the whole stack of cards can come tumbling down. Of course, while some companies can make a comeback after a scandal, many others go down with the ship and file for bankruptcy.

As we peel back the covers of financial greed, here is a list of the 25 Biggest Corporate Scandals Ever.

The Bernie Madoff Ponzi Scheme

This made the list not only for the sheer amount of money involved (at least $65 billion in client accounts) but because the people he conned are some of the smartest people in the world. People entrusted him with their charitable funds, but they were used for his luxurious lifestyle and personal gain.

HealthSouth

Organized and directed by the company’s CEO, Richard Scrushy, this financial hoax involved coming up with fictitious transactions and accounts to boost the company’s earnings. The fraud embezzled $1.4 billion which was reported as the company’s earnings from 1996 to 2003. He almost got away with it when he was acquitted by a “friendly” Alabama jury, but the prosecutors kept at it, and he was convicted in June 2006 of bribery charges made on Alabama’s governor to receive a seat on the medical regulatory board.

Tyco Ltd.

Tyco International is a diversified manufacturing conglomerate that deals with electronic components, health care, fire safety, security, and fluid control with headquarters in New Jersey. In 2005, its CEO, Dennis Kozlowski, and CFO, Mark H. Swartz, were found guilty of stealing $600 million from the company. These two symbolized the excesses of executive compensation at shareholder’s expense, where Kozlowski will be remembered for the $2 million birthday bash he gave his wife on a Mediterranean Island at the company’s expense.

Lance Armstrong and the Livestrong Foundation

Lance Armstrong not only held the title of a Tour de France champion and is the man behind the Livestrong Foundation, but he also owns several businesses and investments. He owns the coffee shop “Juan Pelota Café,” a bike shop named “Mellow Johnny,” and had several million dollars invested in the American bicycle component manufacturer SRAM Corporation. However, due to his doping confessions, he lost his title and several sponsorships, and SRAM cut ties with him.

Enron Corp.

Enron was the “it” company at the turn of the century as it oozed with wealth, smarts, and power. However, this Houston-based energy company toppled into a spectacular bankruptcy due to a painstakingly-planned accounting fraud made by its accounting firm, Arthur Andersen. Once considered a blue-chip stock, Enron shares dropped from $90 to $0.50, which spelled disaster in the financial world when thousands of employees and investors saw their savings vanish with the company as it filed for an earnings restatement in October 2001.

Arthur Andersen

Speaking of Arthur Andersen, this Chicago-based company voluntarily relinquished its licenses to practice as Certified Public Accountants (CPAs) in the USA due to the Enron accounting scandal. This was a blow, considering that it was one of the world’s top five accounting firms prior to the scandal. It resulted in the loss of 85,000 jobs and corporate re-branding.

Bear Stearns Companies Inc.

This is one of the US’s biggest government bailouts that helped avoid a domino effect of financial market failures. Ranking as one of the largest global investment banks, securities-trading and brokerage firms in the world, Bear Sterns was nearly bankrupted before it sold itself to JP Morgan Chase for $2 a share or $240 million. This was furthered bolstered by a guarantee of $30 billion worth of loans given by the Federal Reserve to the company.

Swissair

Swissair, a former national airline of Switzerland and a major international airline, was grounded in October 2001 due to a bad expansion move. With 30% of its shares in stocks owned by the Swiss government, the company implemented the Hunter Strategy, a major expansion program. However, this resulted in a financial crisis that also effected its parent company, SAirGroup, which was already hurt by the September 11 attacks. As the entire Swissair fleet was grounded and officially dismantled in March 2002, it was later acquired by Crossair and the liquidation firm Jurg Hoss.

Parmalat

Parmalat, an Italian company, is the leading global producer of Ultra Hot Temperature (UHT) milk and other foods. However, its founder, Calisto Tanzi, was accused of questionable accounting practices in 2003 when a €14 billion hole was discovered in the company’s accounting records. This resulted in one of the biggest corporate scandals in history. It turns out he was selling credit-linked notes to the company and diverting the company’s funds elsewhere.

BANINTER

Banco Intercontinental, or BANINTER, was the second-largest privately held commercial bank in the Dominican Republic. Its demise resulted from political corruption in 2003 as fraudulent bookkeeping and political influence by all the major Dominican political parties resulted in a $2.2 billion deficit, which was equal to 12 to 15% of the country’s GDP.

Adelphia Communications Corp.

This Pennsylvania-based company was ranked as the fifth largest cable company in the US before it yielded to bankruptcy in 2002 due to internal corruption. The company incurred a $2.3 billion debt, and its founders were charged with securities violations. John and Timothy Rigas were sentenced to 15 to 20 years in prison while five other officers were indicted. They’d made a complicated cash-management system where they diverted funds to other family-owned entities.

Global Crossing Ltd.

This company proved an incredible scandal is not necessarily the end of the business road. In terms of assets, the company’s bankruptcy can be considered the 7th largest filing in American history; the total assets given at the filing were $22.4 billion with debts amounting to $12.4 billion. The debt was amassed by four CEO’s of the computer-networking services company. Each was given $23 million in personal loans which were ultimately forgiven. However, in 2004, the company began to show improved margins and even announced acquisitions of FiberNet and Impsat in 2006.

HIH Insurance

This corporation’s downfall is considered the largest in Australia’s history. HIH Insurance was Australia’s second-largest insurance company until it entered into provisional liquidation in 2001. It incurred losses totaling $5.3 billion where its director, Rodney Adler, was sentenced to four and half years of jail time due to obtaining money by false or misleading statements, and failure to discharge his duties as a director in good faith and in the best interests of the company.

Martha Stewart’s Mess

Martha Stewart is a household name due to her endeavors as a business magnate, author, and magazine publisher. She is very successful in all her business ventures and has numerous bestselling books. However, she became entangled in the ImClone insider trading affair in 2002 and was even indicted on nine counts of securities fraud and obstruction of justice. She was able to bounce back, however, and even regained her company in 2012.

Deutsche Bank Spying Scandal

Deutsche Bank AG is a German global banking and financial services company that was caught spying not only on its board members, but also on the personal life of some of its investors. As Germany’s largest bank and the largest foreign dealer in the world with a presence in Europe, USA, Asia-Pacific, and the emerging markets, the scandal took quite a toll. In 2006, the bank succumbed to paranoia when it hired an external detective agency to snoop on contacts between board members and the Munich-based media magnate, Leo Kirch and his associates, whom they had litigation with. Due to the scandal, the German government vowed to have a new privacy-protection law for workers.

Urban Bank

This was one of the largest banks in the Philippines until it was closed down on the basis of liquidity by the Philippine Deposit Insurance Corp (PDIC). However, the liquidation grounds were not the big issue here. The big scandal was that some of Urban Bank’s officers were later criminally charged with economic sabotage due to their falsified Supervision and Examination Sector (SES) reports to the Monetary Board.

Jerome Kerviel and the Société Générale Banking Scandal

Jerome Kerviel is a rogue trader who tripped up the world’s financial market when his unauthorized trading in the securities markets using the bank’s computers resulted in €4.9 billion losses to the Société Générale funds. The worst part of the issue came when the bank’s executive tried to mask the fraud by “unwinding” his trades. This resulted in trading panic all over the Atlantic, causing a decline in European markets.

Barclays

Barclays, one of the world’s largest banks, was hammered by a scandal involving Libor manipulation, where banks lend each other money at high rates. The company owned up to the allegation that it manipulated the London Interbank Offered Rate which was tied to trillions of dollars worth of financial contracts and derivatives. The issue led to the resignation of the company’s CEO, Bob Diamond, and the company was asked to pay $450 million. Other banks< like UBS, were also under investigation for the Libor-rate rigging.

Bre-X

Barings Bank

Barings Bank is the oldest merchant bank in the city of London, which was founded by the German-born Baring family. This bank handled the Queen’s personal bank and was once the financier of the Napoleonic Wars. However, the bank collapsed in 1995 when one of its bank employees, Nick Leeson, squandered and lost £827 million ($1.3 billion) through speculative investing over a three-year period, which he masked by manipulating records.

Hewlett-Packard Spying Scandal

Siemens

Siemens AG and the Greek government went under fire for corruption and bribery involving the deal for the security systems for the 2004 Summer Olympic Games in Athens. While no serious charges were made, it’s believed that the bribes may have been up to 100 million Euros.

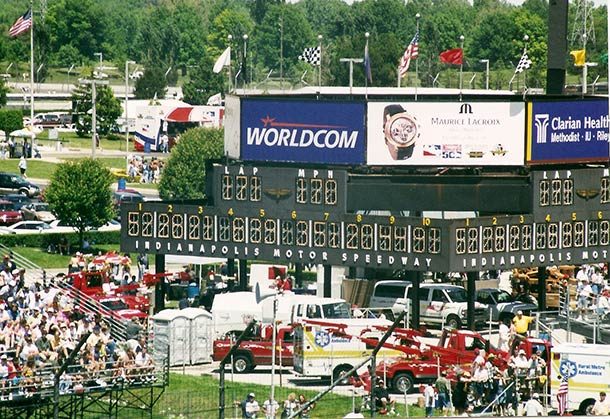

WorldCom

You might have wondered why the US’s second largest long-distance phone company, WorldCom, filed for Chapter 11 in 2002. However, an internal audit report showed that the company had been using fraudulent accounting methods to hide its declining financial condition. The company’s assets were inflated by around $11 billion with $3.8 billion in fraudulent accounts. The company was purchased by Verizon Communications and was renamed Verizon Business Division. It’s worth noting that this scandal prompted the approval of the Sarbanes-Oxley Act by the senate, which introduced the most sweeping new business regulations since the 1930’s.

Volkswagen

Not all corporate scandals have involved insider trading or spying. Some have involved…prostitutes and luxury vacations. In 2005, the VW bribery affair made huge headlines as it was discovered that top executives were using said incentives to secure certain contracts and business relationships…all under the guise that it was in the interest of the company. Even though the story broke in 2005, investigations, resignations, and convictions happened over the course of about five years.

Facebook Data Privacy Scandal

Source: https://www.bbc.com/news/technology-43649018, https://marketingland.com/pew-survey-finds-marked-decline-in-facebook-user-engagement-since-march-247469

Source: https://www.bbc.com/news/technology-43649018, https://marketingland.com/pew-survey-finds-marked-decline-in-facebook-user-engagement-since-march-247469 In early 2018, news sources revealed that over 87 million Facebook users’ data leaked to the political consultancy Cambridge Analytica. Worse yet, Facebook admitted they knew Cambridge Analytica had been siphoning off data through a program called This Is Your Digital Life and did nothing about it. Due to the huge breach in privacy, Mark Zuckerberg faced several hearings with U.S. Congress and the European Union. Their stock and public faith in the platform has plummeted since the scandal.